Out of all the business plan, I was dreading the financial section most, however it’s probably the most important. It addresses how much money you need to start your business, keep it operating, when you’ll be profitable, what you can afford, and where the money even comes from– among other things.

Since you can make your forecasts as detailed and accurate as you want, just the thought of endless numbers makes my head spin! To help start somewhere, I compiled a collection of financial basics to include in your business plan.

Financials Contents

Coffee Shop Profit And Loss

Based in Seattle, Washington, USA, Coffee Shop Startups is dedicated to providing you the most relevant information on how to start a coffee shop business successfully. Over the last 8 years, we’ve helped thousands of aspiring coffee business owners around the world. No matter how efficiently your coffee shop runs, you will still fail if you don’t have a sufficient profit margin per item or a menu that draws in customers. According to Chris, it’s essential that your shop offers variety – but not so much that you end up sacrificing quality.

Budget:

- Calculate your start-up costs. What is needed to open the doors of your coffee shop? This includes all business fees, permits, licenses, insurance, marketing, rent, equipment, and beginning inventory. You should probably include cash float to keep on hand, because if one month no money comes through the door, you’ll still have to pay those operating expenses.

- Calculate your operating expenses. These are the costs to keep your business running day to day, and month to month. This includes business and legal fees, rent, payroll, and your product inventory. Regardless of making any sales, these need to be paid.

Forecast:

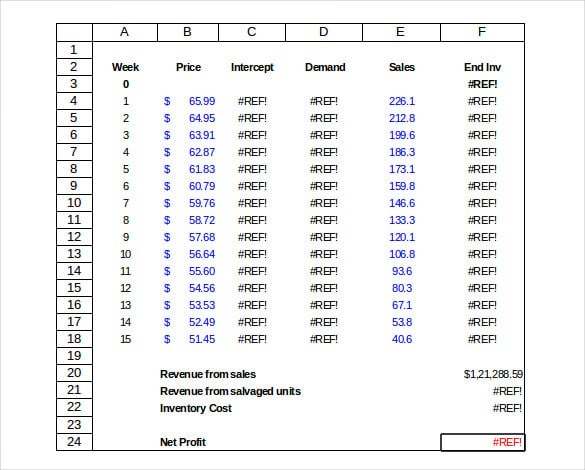

- Draft Pro forma statements to forecast your financial projections. Pro forma just means the numbers are estimated. Depending on how detailed your information is, you can choose to have everything in one excel statement, or create different sheets for your projected sales, income, cash flow, and balance sheet statements. Look up some of these statements to get familiar with the layouts.

- Sales (or revenue)- Estimate how many how many units you’ll sell for what price based on your market share. If you have 150 customers a day, and they each spend $5, your projected sales will be $22,500 a month. Don’t forget to account for seasonality and days open a week.

- Income (or profit & loss)- Estimate your profit from your projected sales after all your expenses are paid:

Revenue (or sales or income)

– Cost of Goods Sold (variable cost of selling your product)

= Gross Margin (or profit)

– Operating Expenses (fixed costs)

= Net Profit - Cash flow–Estimate the balance between cash inflows and outflows. This statement keeps track of how much cash you have at any given point:

Starting Cash

+ Cash In

-Cash Out

= Ending Cash - Balance Sheet– Your balance sheet takes a “snapshot” look of your business financials at any given time, usually month to month:

Assets (cash, accounts receivable, inventory, etc.)

-Liabilities (debts, accounts payable, accrued expenses, etc.)

= Net Worth (or capital)

Come up with different business scenarios: pessimistic, realistic, optimistic and breakeven figures (covering all costs, but no profit). Have figures for every month for the first year, then each year for the next three years. Don’t forget to address assumptions madein your projections.

- Calculate your break-even point. This is the point when all your start-up and operating costs are covered, and you are making profits. Based on your profit and loss, know how long it will take to pay off those start-up costs. Also know how many coffees you need to sell to pay expenses every month. One basic equation you can use:

BEP = (Cost of Goods Sold + Operating Costs) / Dollars Per Sale

= transactions per month

= the number of sales per day to cover your costs and break even

Funding:

- Explain the source and use of funds. Where is your money coming from? If you’re raising money from investors, detail exactly how you plan to use their money. Include where you plan on allocating your profits. When and how much do you plan on paying yourself to cover your own living expenses?

- Mention future plans or exit strategy. Where do you see your coffee shop going? Whether it’s franchising it or selling it, have a plan whether or not your future turns out to be profitable, or running at a loss, or even whether something happens to you where you’re not able to continue the business.

There are different techniques and strategies to predict your numbers, many templates you can use, different things you can include or omit– so research a few and do what works for you. Whether it’s simple or detailed, make sure you understand and find it useful. Definitely draft a budget, sales projections and a profit-loss statement for your company, as many templates are available online too. If anything, your accountant can provide an actual profit/loss, cash flow, and balance sheet you can use for your business.

I used a downloadable template from “Start & Run A Coffee Bar,” Matzen & Harrison that combined the revenue, profit/loss and cash flow projections in a spreadsheet.

Click here for a downloadable Dream|a|Latte Financials Checklist to help outline the financial section of your business plan!

Other Coffee Shop Business Plan Sections:

Simple Profit And Loss Template

- Marketing: Market/Industry Analysis, Competitive/Internal Analysis, & using the Marketing Mix

Sources:

- MSU Management Program

Note: As a fellow aspiring entrepreneur that simply wants to share my journey with you, know this is information I’ve gathered from various books on starting a coffee shop, business websites, and courses that have helped me in writing my business plan to start a coffee shop. I only hope to share some of these resources to help you get started and inspired, however this is by no means extensive. All materials available in this series are for informational purposes only, and not to be business consulting or legal advice– so do contact a licensed consultant, accountant, or attorney to obtain advice with respect to any particular issue or problem.